June 2011 Vol. 66 No. 6

Features

13th Annual Directional Drilling Survey: Mixed Market Recovery For HDD

While the overall market recovery for horizontal directional drilling appears to be improving at the mid-year point of 2011, many contractors are still struggling with sluggish economic conditions.

Overall market recovery was still the top concern for contractors according to results from the 13th Annual Underground Construction HDD Survey of the U.S. market. The exclusive industry research was conducted during March and April.

The project backlog for most contractors is a direct reflection of where in the country they concentrate their work efforts combined with particular market niches. For many areas, 2011 is proving to be a year of feast or famine. For example, a southeast contractor plans to buy up to 20 mini HDD rigs before the end of 2011 as his company’s work on specific telecommunications and electric projects kicks off. “Our crews are booked solid through the first quarter of 2012,” he said, “and we’re bidding on additional projects for the remainder of the year as well.”

Yet, others see the markets as continuing to be depressed. A California contractor commented that “if prices continue to fall, I will start mowing lawns.” One Nebraska contractor fears the HDD market will “further erode until the glut of used machines is pushed out of United States. But 2011 will be okay providing mergers do not impact ILEC, CLEC and capital expenditures.”

This Michigan contractor hopes for the best, he stressed that the cheap prices are putting pressure on others to survive. “The market in terms of the average price per foot can’t go anywhere but up. There are guys boring so cheap the rest of us can hardly stay in business.”

However, while there were some disparaging remarks and legitimate concerns reflected by respondents, most expressed overall confidence about the future of the HDD market. “We’re optimistic and think HDD will utilized more, both now and in the future,” said this West Coast contractor.

A Kentucky contractor defined their market in 2011 as simply: “gas, improved; electric and sewer, steady.” A Midwest contractor says they have seen steady growth in their HDD work: “I see it expanding more every year,” he added.

A Pacific Northwest construction firm sees a bright future: “We are very excited about the industry. This is why we are invested in this company and plan to build it into the largest company possible.”

Expanding opportunities

Diversity of directional drilling applications has been vigorously pursued by pioneering HDD contractors for several years. These efforts grew out of necessity (the result of the fiber optic market crash in 2001) and out of a sincere desire to broaden their markets and find new, practical applications and market niches. “Sure, the last couple of years have been tough,” admitted a Southeast contractor. “But we’ve worked hard to grow our HDD business into many different markets. We’ve always been alert as to exploring new applications. That has helped us tremendously and allowed us to weather the recession in pretty good shape.”

This Alaska contractor agreed, saying their firm has benefited from “increasing applications” of HDD work.

Another part of the HDD success equation has been the broader acceptance of the technology across the underground market. While initially a method used primarily in the energy and telecom markets, HDD has made steady progress in proving its applicability to other areas of underground piping installation. “HDD appears to be getting stronger due to engineers designing work with HDD and environmental issues with open-cut procedures,” observed this Indiana contractor.

Another contractor predicted that “as fuel prices rise, deep trenching will be replaced by cross country directional boring.”

Several survey respondents predicted there would be little change or improvement in the HDD market in the near future. “The market for directional drilling should remain about the same for the next several years – I do not see many changes with the housing market and the economy,” stated this Midwest contractor. A Louisiana contractor concurred: “I see it (the market) staying the same considering the economy.”

The unknown economic future continues to inhibit the HDD industry, says a Northeast contractor. “The current work load is not as stable as it could be. The long term looks a little unstable and needs to be better budgeted to develop a level of comfort for contractors.”

In Arizona, a contractor pointed out that “the near and long term will mirror the economy from here on out since the promise of federal money, be it RUS, SRF funded projects, or road projects, are tapped out.

“The adaptation of HDD and other trenchless technologies continues to climb,” he observed. “However, since it presents a potential for costs savings, we are getting more and more requests to come see if directional drilling is a potential solution on many projects — so much so that we will probably add another medium sized rig.”

Active companies and organizations within the HDD industry continues to include a large number of utilities as that segment comprises 13 percent of the market with contractors accounting for the remaining 77 percent. About 17.6 percent of those involved in directional drilling cite HDD as their primary business focus.

Market driver

One of the positive market drivers in 2011 has been the telecommunications market where the long-delayed “shovel-ready” stimulus projects are finally going full steam (though it took three tries before the money was finally disbursed). Essentially, that construction cycle has been compressed to 18 months, causing the frantic construction rush in some parts of the country. The question remains as to what kind of strength the telecom market will have naturally regained when the stimulus funds are exhausted in 2012.

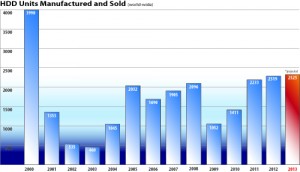

The telecom market routinely uses smaller HDD rigs. So, with parts of the telecom market posting a strong year, it’s no wonder that the projected rig sales for 2011 has jumped to approximately 1,770, up from 1,411 in 2010. In the first quarter of 2011 alone, almost 450 rigs have been sold.

That HDD has been a game-changer for the underground utility construction industry is a given. Since its introduction in the late 80s, the acceptance and indeed, reliance, of the marketplace upon directional drilling has been enormous. Truly the definition of a disruptive technology, HDD now permeates every aspect of the construction market, big applications and small. The average underground utility construction company now owns about eight rigs (of all sizes), up from an average of six rigs just five years ago. Contractors and utilities anticipate that more than 49 percent of their work in 2011 will involve HDD and that will increase to 54.6 percent by 2016.

As the various market dynamics come into play for 2011, there was some shifting in the market shares by discipline. With the increased emphasis on telecommunications construction, it should account for 22.6 percent market share, up from 18.5 percent in 2010. Gas distribution should also see an increase in HDD applications from 16.1 percent in 2010 to 17.3 percent in 2011. Not surprisingly, the utilization of HDD for water and sewer markets declined since the recession is still negatively impacting the cash flow of most cities. In many areas, new municipal construction has largely ground to a halt. HDD water construction fell from 16.6 percent in 2010 to a projected 13.7 percent market share in 2011, with sewer dropping less dramatically from 11.9 percent to 10.9 percent.

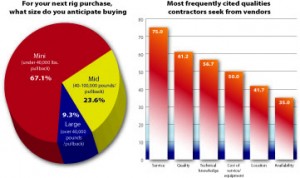

As for current distribution of rig size, the small rig category is at its highest level in five years with 68.3 percent of contractors owning small rigs (under 40,000 pounds of pullback). More than 23 percent own mid-sized rigs (40,000 – 100,000 pounds of pullback) while 8.4 percent own large rigs (greater than 100,000 pounds).

The “other” category of HDD markets continues to include many diverse and innovative applications. But in this year’s survey, geothermal showed up more strongly than in the past. Manufacturers have been predicting (and hoping) that the use of HDD in that market would be increasing substantially. For the first time, geothermal began to show some definitive signs of impacting the market.

Purchasing plans

For the past few years, the trend has been to buy mid-sized and even large rigs for expansion into new markets while replacing small rigs as necessary. But another by-product of the renewed strength of telecom was reflected in the purchasing plans of contractors for 2011 as 67.1 percent plan to invest in small rigs for their next rig purchase, 23.6 percent plan to buy a mid-sized rig and 9.2 percent hope to afford a large rig. In 2010, a contractor averaged purchasing 1.4 rigs while in 2011, contractors plan on purchasing an average of 1.6 rigs.

The used drilling rig market continues to mature and become a substantial factor in trade-ins and purchases. The number of used rig purchases over the past three years has increased in part due to the economic recession where contractors needing to replace units or expand their fleet were looking for alternatives to more expensive new rig purchases. About 51.7 percent HDD owners say they have now purchased used equipment with 46.7 percent saying they will seriously consider buying a used rig for their next purchase. Used mid-sized rigs are the most likely units that contractors will buy according to 51.4 percent of the survey respondents.

Rig owners average 4,064 hours of operation for mini rigs before replacement; mid-sized rigs average 4,238 hours of operation; and large rigs log the most hours during their lifespan at 6,182 hours.

Per foot pricing continues to be very wide-open and hard to definite. Averages for all types of applications ranged from as low as $5 per foot to as high as $140 per foot. As discussed previously, low pricing is a very sensitive subject for all contractors.

Walkover locating systems were utilized by 66.6 percent of rig operators with wireline being used 28.3 percent of the time and other systems about 5 percent.

The HDD fleet grew slightly younger as the number of units that were still operating over 10 years old fell from 12.5 percent in 2010 to 10.0 percent for 2011. This timeframe is marked by the telecom crash when contractors were fleeing the market and those remaining were financially forced to stretch the life of their equipment. In 2010, the number of older units apparently peaked out.

In 2010, about 7.7 percent of contractors reported HDD contracts in excess of $20 million; 13.5 percent grossed between $5 and 10 million for HDD work; 44.2 percent earned between $1 and $5 million; and 34.6 percent made between $500,000 and $1 million. In 2011, 29.9 percent expect to earn more money from HDD contracts, 42.9 percent anticipate about the same HDD revenue and 27.2 percent expect to earn less.

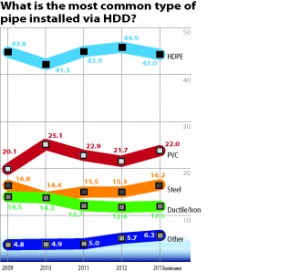

HDPE continues to the most common pipe installed via HDD, being utilized 43.9 percent of the time. Next was PVC pipe at 22.9 percent, steel at 15.5 percent, ductile iron was 12.7 percent, and other types of pipe products at 5 percent.

The need to maintain productivity among HDD units of all sizes remains of paramount importance to contractors in all parts of the country. In fact, 75 percent of contractors list “service” as the most important factor they look for in an equipment/service provider. About 61 percent cited quality, 56.7 percent stressed technical knowledge, cost of service/equipment was cited by 50 percent and the location of their service/equipment providers by 41.7 percent.

Comments